42 coupon rate calculator for bonds

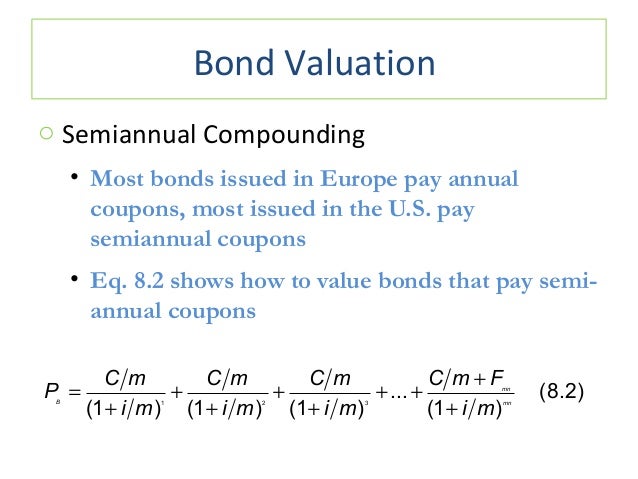

BONDS | BOND MARKET | PRICES | RATES | Markets Insider The nominal value is the price at which the bond is to be repaid. The coupon shows the interest that the respective bond yields. ... The credit terms for bonds, such as the rate of return, term ... Treasury Return Calculator, With Coupon Reinvestment - DQYDJ Treasury Return Calculator, With Coupon Reinvestment Investing August 8th, 2022 by PK The Treasury Return Calculator below uses long run 10-year Treasury Data from Robert Shiller to compute returns based on reinvesting the coupon payments. You can see the total returns for the 10 Year Treasury for any arbitrary period from 1871 until today.

Bonds - MunicipalBonds.com What are municipal bonds? The Key Benefit of Municipal Bonds: Tax-Free Interest; The 5 Basic Elements of Bond Investing; Two Types of Bonds: General Obligation vs. Revenue Bonds; Risks of Bond Investing; Understanding Bond Ratings; The Safety of Municipal Bonds; Default Rates of Municipal Bonds; Taxable-Equivalent Yield; Tax-Exemption from ...

Coupon rate calculator for bonds

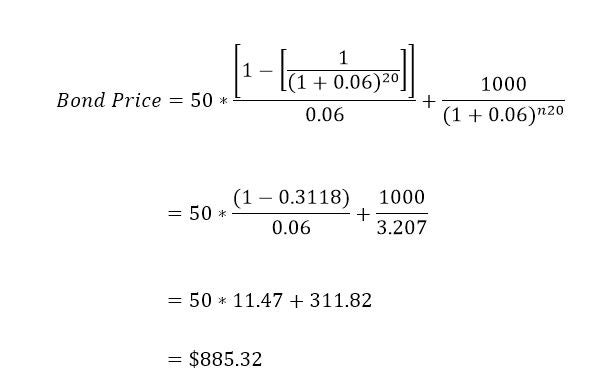

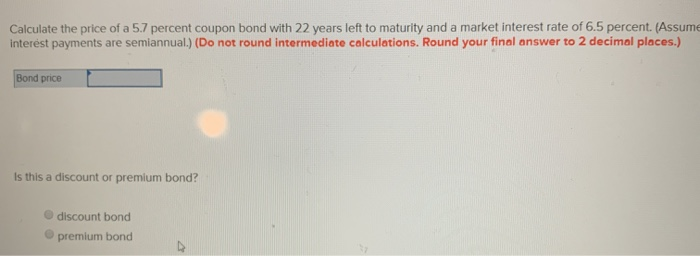

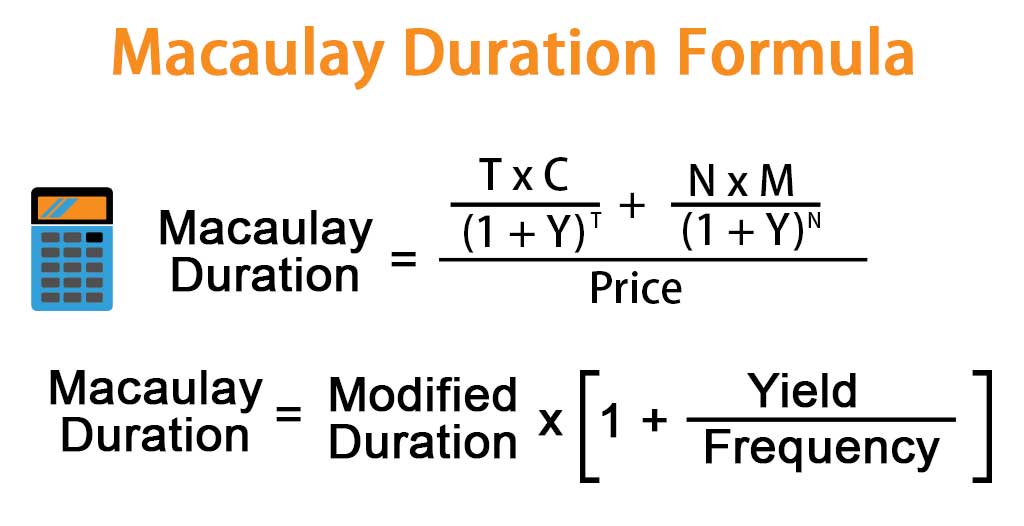

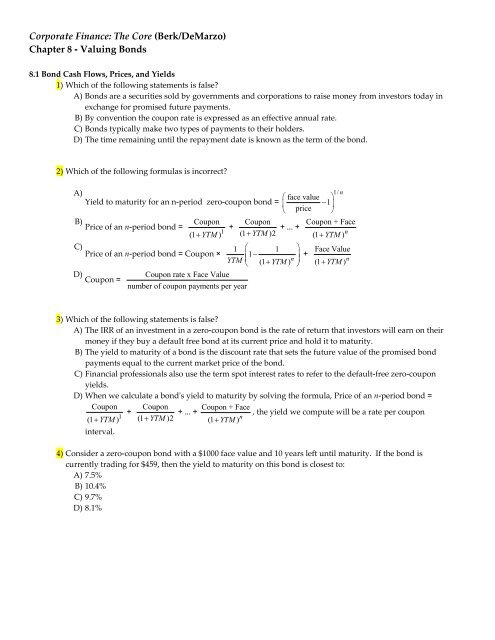

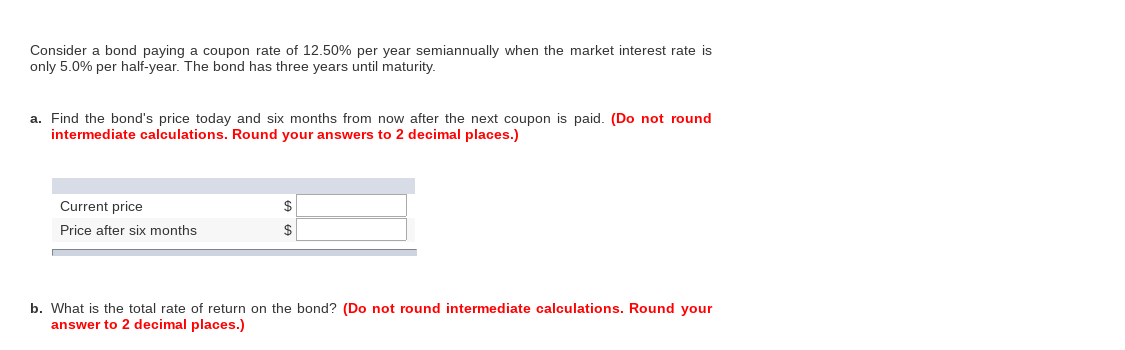

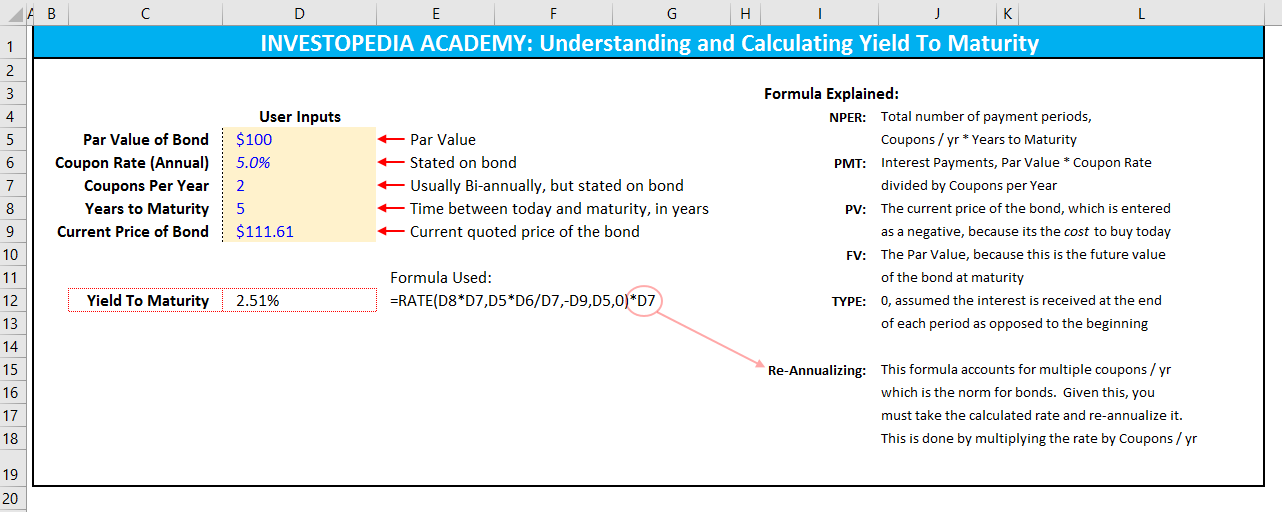

How to Calculate the Bond Duration (example included) m = Number of payments per period = 2 YTM = Yield to Maturity = 8% or 0.08 PV = Bond price = 963.7 FV = Bond face value = 1000 C = Coupon rate = 6% or 0.06 Additionally, since the bond matures in 2 years, then for semiannual bond you'll have a total of 4 coupon payments (one payment every 6 months), such that: t1 = 0.5 years t2 = 1 years How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a... Preferred Stock - YTC Calculator Calculate Yield to Call : Click the Year to select the Call Date, enter coupon call and latest price then Calculate

Coupon rate calculator for bonds. Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). The current yield has changed. Divide 4.5 by the new price, 101. Quant Bonds - Between Coupon Dates - BetterSolutions.com Price Between Coupon Dates You can calculate the price of a bond for dates between coupon dates by 1) Using the PRICE function. 2) Using the YIELD function - uses clean price as an argument SS What is the Clean Price ? Also known as the Flat Price, Quoted Price This is the price excluding any accrued income Traders usually quote clean prices How To Calculate Duration Of A Bond Using Financial Calculator 1) Enter the purchase price of the bond into your calculator. This is the bond's price you paid (or will pay). 2) Enter the bond's face value. This is the amount paid to you when the bond matures. 3) Enter the number of years until the bond matures. 4) Hit the "calculate" button. The duration of a bond is typically expressed in years. How Can I Calculate the Carrying Value of a Bond? - Investopedia Calculating the Carrying Value of a Bond The first step in calculating carrying value requires determining the terms of the bond. For instance, using the effective interest rate method, the...

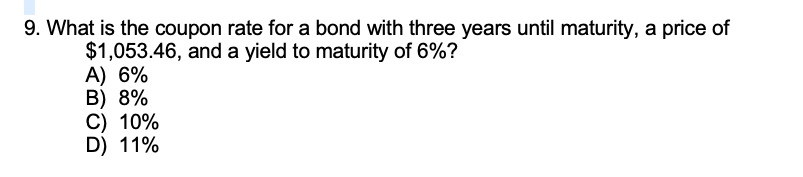

Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders. What Are Series I Savings Bonds? - SmartAsset The interest rate of the bond is a combination of a fixed rate that stays the same for the life of the bond and an inflation rate that is set twice a year. At the time of writing, the interest on a Series I bond issued from May 2022 through October 2022 was 9.62%. Series I bonds are nonmarketable. Quant Bonds - Between Coupon Dates - BetterSolutions.com Quant Bonds - Between Coupon Dates Yield Between Coupon Dates There are several ways you can calculate the yield to maturity for dates that fall between coupon dates: 1) Using the IRR function 2) Using the YIELD function 3) Using the XIRR function 4) Using the Secant Method 5) Using the Bisection Method 6) Using the Newton Raphson Assumptions How Do I Determine the Fair Value of a Bond? - Smart Capital Mind To illustrate, is helps to consider a bond that has $1,000 USD par value, pays $100 coupon per year, with a 9% yield or discount rate, and will mature in three years. P = 100/ (1+0.09) + 100/ (1+0.09)^2 + 100/ (1+0.09)^3 + 1000/ (1+0.09)^3, which is equal to the fair value of $1025.31 USD.

How to Find Coupon Rate of a Bond on Financial Calculator Coupon Rate = (Coupon Payment / Par Value) x 100 For example, you have a $1,000 par value bond with an annual coupon payment of $50. The bond has 10 years until maturity. Using the formula above, we would calculate the coupon rate as follows: Coupon Rate = ($50 / $1,000) x 100 = 5% Own or Dealer Bid 10-Year High Quality Market (HQM) Corporate Bond Spot Rate Graph and download economic data for 10-Year High Quality Market (HQM) Corporate Bond Spot Rate (HQMCB10YR) from Jan 1984 to Jul 2022 about 10-year, bonds, corporate, interest rate, interest, rate, and USA. ... Because high quality zero coupon bonds are not generally available, the HQM methodology computes the spot rates so as to make them ... EOF Preferred Stock - YTC Calculator Calculate Yield to Call : Click the Year to select the Call Date, enter coupon call and latest price then Calculate

How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a...

How to Calculate the Bond Duration (example included) m = Number of payments per period = 2 YTM = Yield to Maturity = 8% or 0.08 PV = Bond price = 963.7 FV = Bond face value = 1000 C = Coupon rate = 6% or 0.06 Additionally, since the bond matures in 2 years, then for semiannual bond you'll have a total of 4 coupon payments (one payment every 6 months), such that: t1 = 0.5 years t2 = 1 years

Post a Comment for "42 coupon rate calculator for bonds"